Although it might appear frightening to buy gold the process need not trigger tension. Start your investment journey by exploring gold ETFs and shared funds which allow you to participate in gold's market performance without owning tangible gold assets. The accessibility of several financial investment choices allows you to explore gold mining stocks as a choice. Purchasing gold-producing business through their stocks offers you prospective profit chances if gold rates increase. Investors who wish to connect their monetary assets to gold market trends should consider this choice. Including a percentage of gold to your portfolio helps handle threat through diversity. This strategy helps guarantee your investments remain secured throughout market variations while supplying psychological security.

Understanding Gold as an Investment

Financiers select gold because they see it as a reputable store of worth. Financiers ought to find out about numerous gold investment techniques and its economic history together with gold market operations. This helps in making educated financial investment decisions.

Types of Gold Investments

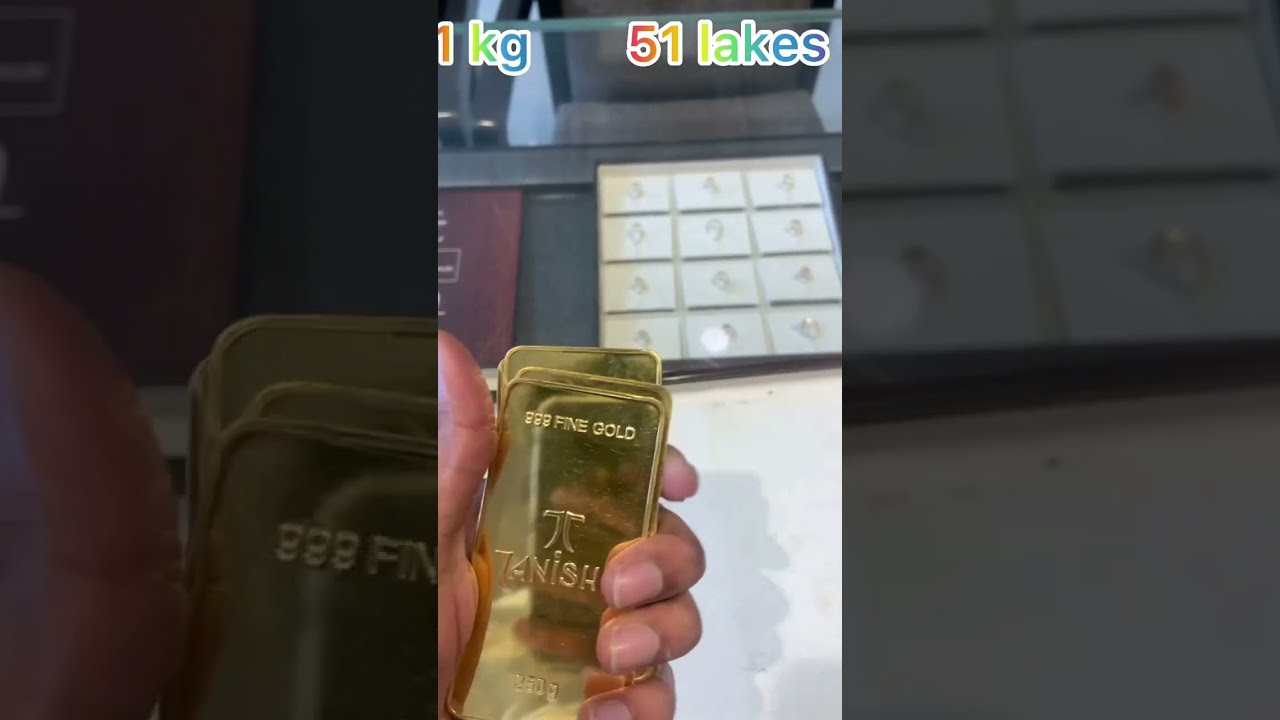

There are numerous methods to invest your money in gold. Physical gold includes bars, coins, and precious jewelry. These concrete properties require safe storage.

The History of Gold in the Economy

For millennia humans have actually recognized gold as an important property. Gold functioned as a material for developing coins and fashion jewelry in ancient civilizations. The gold standard became the backbone for currency systems throughout many countries. The gold basic established currency stability by straight linking its value to gold. Regardless of many countries moving far from the gold standard throughout the 20th century gold continues to shape monetary policy choices today. During durations of financial instability, financiers usually look for gold as a safe and secure investment option. Comprehending its historic role allows you to understand why gold remains important to the economy today.Gold Market Mechanics

The global gold market operates through supply-demand dynamics that identify its costs. Reserve banks together with investors and manufacturers work as the main individuals in the gold market. Gold rates vary based on inflation levels and changes in currency worths together with geopolitical occasions. The market runs with U.S. dollars as its primary currency which indicates rate fluctuations can result from changes in currency exchange rates. Spot prices represent the present market value compared to futures rates which forecast anticipated future market price. When you understand these market mechanics you can monitor how gold carries out and choose financial investments carefully.Strategies for Stress-Free Gold Investing

Reliable gold investment requires the establishment of exact goals while maintaining reasonable expectations and utilizing diversity benefits. The financial investment strategy becomes calm and computed through the crucial contributions of each step.Setting Investment Goals

Figure out the particular results you expect from your gold investment. What type of gold investment return are you looking for stability and security against inflation or long-lasting development? Identifying your financial investment goals serves to direct your decision-making process while likewise helping to reduce stress levels.Break your goals into smaller sized, attainable steps. You might pick to invest a specific part of your portfolio into gold each month. This technique assists keep order in your plan while enabling easy tracking of your development.

Regularly evaluating these objectives is necessary. You should customize your method to adjust to the moving market conditions. Maintaining awareness about market trends assists match your financial investment choices with your monetary goals.

Managing Expectations

Gold's value can fluctuate. It is essential to set reasonable expectations. Gold keeps its value yet it does not guarantee short-term revenue returns. Understand this to prevent unnecessary worry.

Researching historical efficiency assists. Gold generally maintains its value but market modifications can impact it. Evaluating historic patterns will offer you with a thorough viewpoint.

Consider your timespan. People who buy gold for the long term experience reduced stress due to the fact that their financial investments are not impacted by brief market modifications. To reach your investment objectives it is vital to practice patience.

Diversification Benefits

When you consist of gold alongside other investments you can disperse danger throughout your financial portfolio. Your portfolio gains stability from this strategy which minimizes the results of market volatility. Gold investment performance generally varies from that of stocks and bonds. Your portfolio diversity gain from investing in different gold forms such as coins, bars, or ETFs. Every financial investment alternative presents unique advantages and risks.Balance is important. Combining gold investments with realty and equities assists foster more consistent growth. This diversified investment technique assists to lower sudden market motions.

Analyzing Gold Investment Options

As a financier thinking about gold there are numerous financial investment courses available to you. Financial investment choices include acquiring physical gold while likewise buying gold-related securities and investigating monetary items such as ETFs and mining stocks. Every choice presents unique benefits in addition to downsides. Knowing these details will help you in making a decision aligned with your financial investment goals.Physical Gold vs. Gold Securities

Physical gold exists in formats such as coins and precious metal bars. Pros include tangible ownership and historical value. Cons involve storage and insurance costs. Buying physical gold may lead to paying above the market rate. The nature of gold securities differs from physical gold due to the fact that they represent ownership in gold mining or refining business. They don't need physical storage. The value of gold securities depends both on company efficiency metrics and fluctuations in gold costs.Gold ETFs and Mutual Funds

Gold ETFs follow gold's market price while being readily available for purchase and sale through stock market. They offer simple access and liquidity. When you buy a gold ETF you can gain direct exposure to gold prices without requiring to deal with physical gold. Shared funds work as managed financial investment portfolios which may include gold or possessions linked to gold. They offer diversity and expert management. Purchasing ETFs or mutual funds reduces the risks connected with holding gold alone.Mining Stocks and Gold IRAs

Buying mining stocks suggests purchasing equity in business that extract and manufacture gold. The possible profits and dangers from mining stocks depend on gold rate variations and the mining company's results. rollover to gold IRA Pension known as Gold IRAs shop gold or securities connected to gold. Gold IRAs supply comparable tax benefits to other retirement accounts however require meticulous setup. You should assess both storage conditions and service charge before selecting a gold IRA.Executing the Investment

Buying gold ends up being easy when you find a trustworthy broker and comprehend the expenses before selecting a storage alternative for your gold. These procedures form the foundation of a secure investment experience that operates without tension.Choosing the Right Dealer/Broker

You need to discover a reputable gold dealer or broker for your financial investment requirements. Examine that they maintain a strong credibility and numerous favorable evaluations. Inspect if they come from industry groups due to the fact that subscription shows trustworthiness. Cost comparison amongst dealerships is vital considering that some deal lower costs or remarkable rates. High-pressure sales methods and assurances of huge profits ought to be approached with caution. Choose dealerships who clearly reveal their rates structures and company practices. Considering that gold markets shift rapidly you must partner with a credible consultant who provides authentic support.Understanding Taxes and Fees

Make certain to examine both potential taxes and costs before deciding to purchase gold. Capital gains tax may apply to your gold sale based on your nation's particular tax policies. Coins, bullion, and ETFs represent gold investment lorries that could result in various tax consequences. Stay informed about possible fees throughout the buying or selling cycle. The buying or offering process could include brokerage costs in addition to storage costs and insurance coverage costs. Advance knowledge of all costs enables you to prevent unexpected costs and control your mutual fund efficiently.Secure Storage Solutions

Protecting your gold storage prevents theft and damage to your properties. Home storage of your gold is an alternative however requires cautious risk evaluation and adequate home insurance coverage defense. Expert storage centers or bank safe-deposit box provide a more safe storage option. Most professional storage facilities offer complete insurance protection and cutting edge security systems. Assess their charges in addition to ease of access and terms to figure out the best option. Keeping a detailed record of your assets assists you during insurance claim procedures.Monitoring and Changing Your Investment

To achieve gold investment success you must keep an eye on market trends continually while carrying out regular portfolio assessments and understand optimum selling minutes. By following these practices you will preserve the positioning of your gold investment with your monetary objectives.Staying Informed on Market Trends

The value of gold fluctuates according to various market influences. Stay updated on international economic developments while monitoring interest rate patterns and currency market variations. Stay notified about gold financial investments through relied on sources such as monetary news sites and specialist analyses along with market reports.Technology can be practical here. Trigger phone informs or download financial apps for real-time updates. Staying informed allows you to make clever investment choices and react swiftly to any important market advancements.

Rebalancing Your Portfolio

As time advances your investments will experience changes in value. This can make your portfolio out of balance. Make regular evaluations of your gold holdings together with your other financial investments. By doing this you can keep your financial investments lined up with both your monetary goals and the level of threat you are comfortable with.Set a schedule for these evaluations. While some investors carry out portfolio reassessments on a quarterly basis others prefer to do it yearly. Evaluate your portfolio evaluations to make needed financial investment changes. Extreme growth of gold relative to your other assets might require you to divest from it and purchase different financial investments.

Knowing When to Exit

You must offer your gold investment when changing conditions develop. Screen your monetary accomplishments Trusted Financial sources,Investment Strategies,Gold Investment Tips,Retirement Planning Resources,Financial News Articles,Precious Metal Insights,Retirement Savings Guides,Investment Education, and any modifications in market patterns. A persistent decline in gold costs need to trigger you to either sell your position or reduce your financial investment.Decide on your exit technique in advance. Develop an exact price at which you will sell your assets or carry out Trusted Financial sources,Investment Strategies,Gold Investment Tips,Retirement Planning Resources,Financial News Articles,Precious Metal Insights,Retirement Savings Guides,Investment Education, stop-loss orders to protect your financial investment. By executing this technique you secure your profits when market prices go down while preventing psychological selling decisions.