Precious steels investments have actually become a common method to diversify retired life portfolios via Person Retired life Accounts (IRAs) and self-directed IRAs. This piece explores the interpretation of precious metals and the various kinds you can invest in. The post details just how precious metals can benefit your individual retirement account with tax-deferred growth and possession defense while supplying a detailed configuration guide. The short article stresses the importance of assessing pureness metrics along with liquidity capacity and diversification benefits while satisfying IRS requirements to prepare you for sound financial investment choices. Precious metals contain unusual metallic elements that take place naturally and have strong financial worth that makes them beneficial for financial investment functions as a result of their integral well worth and historic significance. Investors make use of gold as protection against rising cost of living and as a crucial part of their wide range management methods. The worth of silver relaxes in its dual-purpose nature which includes commercial use and financial investment possibility. Platinum and palladium now play more significant roles in product markets because of their significance in manufacturing and automobile supply chains.

Definition and Kinds of Valuable Metals

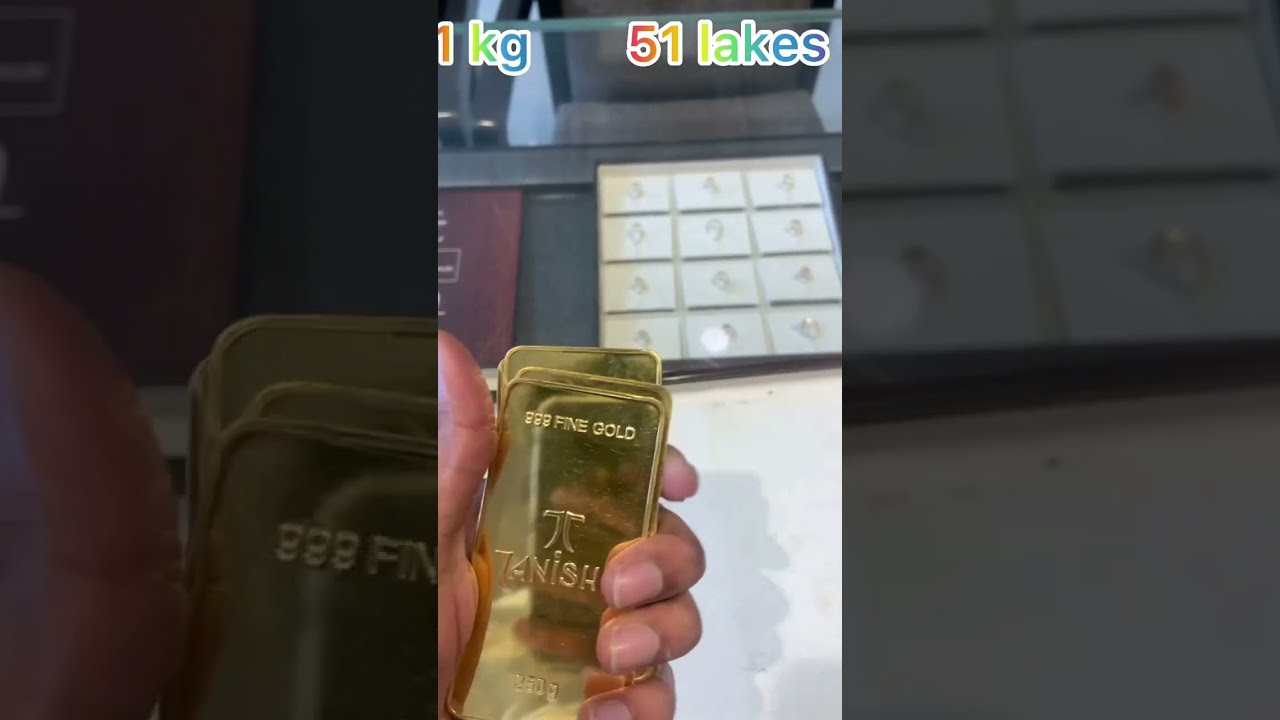

Precious metals consist of metallic elements with substantial economic value that investors commonly keep in bullion and coin kinds. Capitalists pick these precious metals to shield against inflation and financial instability while offering currency security and making them important parts of diversified investment profiles. Bullion stands for a standard investment option whereas coins hold numismatic value which raises their total worth. What are the benefits of utilizing an IRA to buy precious metals? A self-directed IRA investment in precious metals brings special advantages that enhance your retired life economic safety and asset defense. Active financial investment management and portfolio diversification advantages are included. Precious metals give security against rising cost of living which helps maintain your riches and they also add diversity benefits to your investments. Checking out the benefits and dangers connected to precious metal investments Precious metals give multiple advantages because they traditionally protect against market volatility, rising cost of living, and geopolitical risk which makes them necessary to any kind of varied investment portfolio. Steady asset performance brings about much better lasting investment results and increased economic protection. Many individuals select to include silver and gold to their investment collections as a protective measure against rising cost of living and political instability. Financiers should keep an eye on market problems since despite the fact that precious metals use security and stability they need to understand how different factors might influence their financial investments. Financial investment approaches for precious metals within an IRA need understanding conformity and guardianship demands. Buying precious metals via an individual retirement account requires several actions to ensure IRS regulation compliance while maintaining appropriate asset allowance and protecting your investments. The process of establishing an IRA account for precious metals consists of multiple crucial actions to make certain conformity with IRS regulations while making it possible for safe custodianship and correct possession allowance. Developing a precious metals individual retirement account demands comprehensive assessment of several components such as choosing a reputable custodian and comprehending the rollover treatment for present pension while additionally assessing custodian costs and tax consequences. Financiers need to research and choose a custodian with know-how in precious metal IRAs. This action ensures that custodians have comprehensive knowledge concerning financial investment possibilities and internal revenue service regulations. After establishing a relationship with your selected custodian you will need to start the rollover process which usually needs moving funds from your traditional IRA or one more qualified retirement account right into the rare-earth element individual retirement account. Comprehending internal revenue service storage rules and permissible steels along with reporting demands can enhance investment outcomes by empowering capitalists to with confidence examine their choices. Vital elements to review when selecting precious metals for your IRA investment. You must examine purity degrees, market liquidity, market patterns and diversification chances when choosing precious metals to contribute to your IRA.Purity, Liquidity, and Diversification

Buying precious metals for an IRA calls for careful factor to consider of purity and liquidity due to the fact that these aspects directly affect the property's worth in addition to its market demand and capacity to be converted into cash money. Liquidity is vital since it allows capitalists to offer steels swiftly when market situations need it. The execution of this strategy enhances potential financial investment gains while fortifying your economic plan and provides a protected technique to managing economic changes to shield your economic future.What is an IRA precious metals account?

A precious metals IRA represents an unique retirement account that permits investments in physical precious metals consisting of gold, silver, platinum, and palladium. IRA precious metals accounts supply conventional tax benefits while supplying investment diversity and growth chances through precious metals. Which precious metals are qualified for financial investment through an IRA? An individual retirement account allows capitalists to choose from multiple precious metals choices such as gold, silver, platinum and palladium. Investors can choose metals as bars or coins and pick certain bullion enters their investments. Some precious metals are not allowed in Individual retirement accounts so it is necessary to confirm permitted financial investments with your account service provider prior to making decisions. What benefits can an investor gain by choosing precious metals for their individual retirement account financial investments? Investing precious metals via an IRA helps diversify your investment profile. Precious metals serve as a protective investment versus inflation and market changes which enables them to supply financial security throughout durations of financial instability. Precious metals show historical long-lasting growth potential that makes them crucial for retired life investment techniques. Do individual retirement account precious metals accounts feature any kind of service fee? An individual retirement account precious metals account may sustain fees similar to those located in other individual retirement account kinds. Individual retirement account precious metals accounts might need repayments for account upkeep along with deal and Discover Investment Insights storage space costs. You must conduct comprehensive study to compare various individual retirement account companies and pick the one that presents the lowest expenses for your particular financial investment demands. Is it feasible for me to have physical possession of precious metals within my IRA account? The internal revenue service needs that precious metals in an IRA be kept by either a custodian or trustee to guarantee regulatory compliance and safe and secure storage space. Your account does not enable you to take physical belongings of the stored steels. You have the alternative to obtain physical property of the steels from your account once you start retired life withdrawals. Is it feasible to move funds from my current retirement account right into an IRA that holds precious metals? Standard IRAs, Roth IRAs and 401(k)s can be converted into individual retirement account precious metals accounts to achieve diversification and increase lasting wide range. Individuals who want to expand their retirement cost savings profile can gain from this technique because it enables them to take part in precious metals market development. Contact both your account carrier and financial consultant to assess whether a rollover fits your needs.